We have eight real-time sample risk-parity inspired portfolios maintained at Fidelity that we monitor and track each week. For convenience, we have named them:

-

All Seasons;

-

Golden Butterfly;

-

Golden Ratio;

-

Risk Parity Ultimate;

-

Accelerated Permanent;

-

Aggressive Fifty-Fifty;

-

Levered Golden Ratio; and

-

O.P.T.R.A.

Each portfolio is constructed using the 3 principles explained in Episode 7:

-

The Holy Grail Principle

-

The Macro Allocation Principle

-

The Simplicity Principle

Each of them was funded with $10,000 on July 13, 2020, except for:

-

The All Seasons, which was funded with $10,200 on July 21, 2020;

-

The Levered Golden Ratio, which was funded with $10,000 on July 1, 2021;

-

O.P.T.R.A., which was funded with $10,000 on July 1, 2024.

For reference, on July 13, 2020, the S&P opened at 3205 and the NASDAQ at 10,729.

We are distributing from them monthly at the rates specified in the Portfolio Policies section of each portfolio. The withdrawal rates are intentionally aggressive to demonstrate that these types of portfolios can withstand higher safe withdrawal rates than ordinary stock/bond mixes. Also included is a correlation matrix and a backtest for each portfolio generated at the testfolio website.

Year-to-Date Performance of Assets

As of | S&P 500 (VOO) | NASDAQ 100 (QQQ) | US Small-cap Value (VIOV) | Gold (GLDM) | Long-term Treasuries (VGLT) | REITs (REET) | Commodities (PDBC) | Managed Futures (DBMF) |

|---|---|---|---|---|---|---|---|---|

June 6 | 2.55% | 3.81% | 9.60% | 26.16% | -0.02% | 4.80% | -0.08% | -2.57% |

What Is It

The Golden Butterfly is the brainchild of Tyler, the founder and operator of the website www.portfoliocharts.com. It is a conservative portfolio and is comprised of four asset classes in five funds that are equally weighted: 20% total U.S. stock market (VTI), 20% small cap value stocks (VIOV), 20% long-term treasury bonds (TLT/VGLT), 20% short term treasury bonds (SHY) and 20% gold (GLDM).

Historical Performance

Since 1970, it has a compounded annual growth rate (after inflation) of 6.4%, and an expected permanent safe withdrawal rate of 5.3%. Here is the current correlation matrix and a backtest with an inflation-adjusted 5% annualized distribution taken monthly.

Portfolio Policies

We will re-balance this portfolio annually. We will be distributing 5% annualized from this portfolio each month, which is the mathematical equivalent of dividing the ending monthly balance by 240 and distributing that amount on the first trading day of the next month. If the portfolio falls below 80% of its starting value, we will reduce the withdrawal rate to 4% annualized until it returns to its starting value. We will sell a portion of the currently most productive fund as necessary to support the monthly withdrawals.

Rebalancings

We rebalanced this portfolio on July 21, 2021, to its original allocations based on its value of $11,429 on July 20, 2021. This involved selling $720 VIOV and $395 VTI and buying $485 TLT, $325 GLDM and $300 SHY. We rebalanced again on July 22, 2022 based on the balance of $9,955 on July 21, 2022. This involved selling $47 GLDM, $116 SHY and $88 VIOV, and buying $21 VTI and $245 TLT. On December 21, 2022, we tax-loss harvested TLT and replaced it with VGLT. We rebalanced again on July 20, 2023 based on the value of $10,073 on July 19, 2023. This involved selling $116 GLDM, $9 VIOV and $257 VTI, and buying $56 SHY and $248 VGLT. We rebalanced again on July 22, 2024, which involved selling $200 VTI and $197 GLDM, and buying $117 SHY, $256 VGLT and $14 VIOV.

Current Status

We distributed $45 from GLDM for June 2025 and have distributed $2573 total since inception ($647 GLDM, $628 VIOV, $180 VTI, $93 TLT/VGLT, $166 SHY and $865 cash) and $272 YTD. Here it is as of June 13, 2025. It is up 1.61% for June and up 5.29% YTD. It is up 41.11% since inception in July 2020. For 2024, it was up 11.01% and we distributed $523.

What Is It

The All Seasons portfolio is a reference portfolio that is modeled after Ray Dalio's All Weather portfolio and is described in "Money: Master the Game" by Tony Robbins. It is a very conservative portfolio that is comprised of four asset classes in five funds, allocated as follows: 30% total U.S. stock market (VTI), 40% long-term treasury bonds (TLT/VGLT), 15% intermediate-term treasury bonds (VGIT) 7.5% gold (GLDM) and 7.5% commodities (PDBC).

Historical Performance

Since 1970, it has a compounded annual growth rate (after inflation) of 5.6%, and an expected permanent safe withdrawal rate of 3.8%. Here is the current correlation matrix and a backtest with an inflation-adjusted 4% annualized distribution taken monthly.

Portfolio Policies

We will re-balance this portfolio annually. We will be distributing 4% annualized from this portfolio each month, which is the mathematical equivalent of dividing the ending monthly balance by 300 and distributing that amount on the first trading day of the next month. If the portfolio falls below 80% of its starting value, we will reduce the withdrawal rate to 3% annualized until it returns to its starting value. We will sell a portion of the currently most productive fund as necessary to support the monthly withdrawals.

Rebalancings

We rebalanced this portfolio on July 21, 2021, to its original allocations based on its value of $10,802 on July 20, 2021. This involved selling $690 VTI and $215 PDBC, and buying $665 TLT, $165 VGIT and $90 GLDM. We rebalanced again on July 22, 2022 based on the balance of $9,248 on July 21, 2022. This involved selling $61 GLDM, $66 VGIT and $88 VTI, and buying $6 PDBC and $347 TLT. On December 21, 2002, we tax-loss harvested TLT and replaced it with VGLT. We rebalanced again on July 20, 2023 based on the value of $9,038 on July 19, 2023. This involved selling $119 GLDM and $403 VTI, and buying $143 PDBC, $21 VGIT and $357 VGLT. We rebalanced again on July 22, 2024, which involved selling $394 VTI and $92 GLDM and buying $73 PDBC, $39 VGIT and $379 VGLT.

Current Status

We distributed $31 from GLDM for June 2025 and have distributed $1877 total since inception ($95 GLDM, $68 TLT/VGLT, $33 VGIT, $367 VTI, $192 PDBC and $1149 cash) and $187 YTD. Here it is as of June 6, 2025. It is up 0.49% for June and up 3.28% YTD. It is up 12.12% since inception in July 2020. For 2024, it was up 7.11% and we distributed $367.

What Is It

The Risk Parity Ultimate is a diverse portfolio that is designed for medium and long-term needs. It was originally comprised of 12 different funds in six different asset classes: 50% stock and REIT funds (split into 12.5% VUG, 12.5% VIOV, 10% REET, 6.25% USMV, 6.25% SPLV and 2.5% UPRO), 25% long-term treasury bond funds (split into 15% TLT, 5% EDV and 5% TMF), 12.5% preferred stock funds (PFF), 10% gold (GLDM), and 2.5% in a stock market volatility tracking fund (VXX). On July 21, 2021 it was rebalanced and modified to include even more diverse holdings. For the next year it was comprised of 45% stock and REIT funds (12.5% VUG, 12.5% VIOV, 5% USMV, 5% KBA, 5% UPRO and 5% REET); 20% long-term treasury bonds (15% TLT/VGLT and 5% TMF); 15% gold (GLDM), 10% preferred shares (PFF), 5% commodities (COM), 3% volatility tracking (VIXY) and 2% crypto-assets (1% BITW and 1% BITQ). On July 22, 2022 it was rebalanced and modified slightly again. Since then it has been comprised of 45% stock and REIT funds (12.5% VUG, 12.5% VIOV, 5% USMV, 5% KBA, 5% UPRO and 5% REET); 20% long-term treasury bonds (15% TLT and 5% TMF); 15% gold (GLDM), 10% managed futures and commodities (5% COM and 5% DBMF), 5% preferred shares (PFF), 3% volatility tracking (VIXM) and 2% crypto-assets (1% GBTC and 1% ETHE). On July 2023 it was rebalanced and modified slightly again. Since then it has been comprised of 45% stock and REIT funds (15% VIOV, 10% VUG, 5% USMV, 5% UPRO, 5% REET and 5% KBA; 25% treasury bonds and preferreds (15% VGLT, 5% TMF and 5% PFF); 15% gold (GLDM); 10% managed futures and commodities (5% COM and 5% DBMF); and 5% other alternatives (3% BTAL, 1% BTC and 1% ETH). The crypto assets are now held in a separate account. On July 22, 2024, we rebalanced and made additional slight modifications. Since then it has been comprised of 45% stock and REIT funds (15% VIOV, 10% VUG, 5% USMV, 5% UPRO, 5% REET and 5% KBA; 25% treasury bonds and preferreds (15% VGLT, 5% TMF and 5% PFFV); 15% gold (GLDM); 10% managed futures (DBMF); and 5% other alternatives (3% BTAL, 1% BTC and 1% ETH).

Historical Performance

Testfolio's 10-ticker limit for its Asset Analyzer tool prevents the generation of a correlation matrix. Here is a backtest with an inflation-adjusted 6% annualized distribution taken monthly. Testfolio does not provide historical prices for Ethereum. The backtest uses Bitcoin as a proxy, allocating 2% to it.

Portfolio Policies

We will re-balance this portfolio annually. We will be distributing 6% annualized from this portfolio each month, which is the mathematical equivalent of dividing the ending monthly balance by 200 and distributing that amount on the first trading day of the next month. If the portfolio falls below 80% of its starting value, we will reduce the withdrawal rate to 5% annualized until it returns to its starting value. We will sell a portion of the most productive asset as necessary to support the withdrawals.

Rebalancings

We rebalanced this portfolio of July 21, 2021, to its revised allocations based on its value of $11,381 on July 20, 2021. This involved selling $205 VUG, $325 VIOV, $195 USMV, $763 SPLV, $421 EDV, $260 PFF, $805 REET and $32 VXX, and buying $565 KBA, $350 TLT, $215 TMF, $755 GLDM, $565 COM, $340 VIXY, $110 BITQ and $110 BITW. We rebalanced again on July 22, 2022 to its revised allocations based on the balance of $9,159 on July 21, 2022. This involved selling $43 BITQ, $38 BITW, $67 COM, $142 GLDM, $524 PFF, $40 REET, $87 USMV, $143 VIOV, and $214 VIXY, and buying $91 GBTC, $96 ETHE, $33 KBA, $456 DBMF, $40 TLT, $204 TMF, $118 UPRO, and $273 VIXM. On December 21, 2022, we tax-loss harvested TLT and replaced it with VGLT. We rebalanced again on July 20, 2023, to its revised allocations based on the value of $8,840 on July 19, 2023. This involved selling $10 COM, $94 ETHE, $120 GBTC, $119 GLDM, $129 UPRO, $35 USMV, $160 VIXM and $494 VUG, and buying $80 DBMF, $88 BTC, $88 ETH, $139 KBA, $19 PFF, $173 TMF, $113 VGLT, $186 VIOV and $264 BTAL. We rebalanced again on July 22, 2024 based on a value of $9381 on July 21, 2024. This involved selling $174 VUG, $37 USMV, $208 UPRO, $108 GLDM, $2 BTAL, $20 BTC, and $33 ETH, and buying $72 VIOV, $187 VGLT, $215 TMF, $18 REET, $12 PFFV, $49 KBA, along with incorporating COM into DBMF and adding $37 to that.

Current Status

We distributed $39 from BTC for June 2025 and have distributed $2686 total since inception ($478 GLDM, $548 VIOV, $108 VUG, $116 UPRO, $49 COM, $41 DBMF, $114 BTC, $38 ETH and $1194 cash) and $236 YTD. Here it is as of June 13, 2025 -- there is a separate account for crypto assets and the real combined total is $9526. It is up about 1.53% for June and up 3.41% YTD. It is up 23.34% since inception in July 2020. For 2024, it was up 13.18% and we distributed $463.

Note that the graph below does not include the separate crypto account.

What Is It

The Golden Ratio is a conservative portfolio that is designed for medium to long-term needs. It is based on the mathematical golden ratio known to the ancients, which is approximately 1.618 and is represented by the Greek letter phi. It is a flexible template of five asset classes or allocations that are weighted by successive applications of the golden ratio, resulting in allocations slots of 42%, 26%, 16%, 10% and 6%. The portfolio can be made more aggressive or conservative by adjusting the assets used in each of the five allocation slots. In the original version, we used 42% stocks (split into 14% large cap growth (VUG), 14% small cap value (VIOV) and 14% low volatility (USMV)), 26% long-term treasury bonds (TLT/VGLT), 16% gold (GLDM), 10% REITs (REET) and 6% cash (money market).

On December 31, 2024, we revised the allocations to include managed futures and so in this variation the allocations are 42% in stocks (split into 21% large cap growth (VUG) and 21% small cap value (VIOV), 26% long-term treasury bonds (VGLT), 16% gold (GLDM), 10% managed futures (DBMF) and 6% cash (money market). This is similar to what we hold as allocations in our real life retirement portfolio, although we hold additional funds in each category and do not hold that much cash in favor of additional equities.

Historical Performance

Since 1970, the original version has a compounded annual growth rate (after inflation) of 7.0%, and an expected permanent safe withdrawal rate of 5.0%. Here is the current correlation matrix and a backtest with an inflation-adjusted 5% annualized distribution taken monthly.

Portfolio Policies

We will re-balance this portfolio annually. We will be distributing 5% annualized from this portfolio each month, which is the mathematical equivalent of dividing the ending monthly balance by 240 and distributing that amount on the first trading day of the next month. If the portfolio falls below 80% of its starting value, we will reduce the withdrawal rate to 4% until it returns to its starting value. We will sell the money market asset first and a portion of the most productive fund after that as necessary to support the withdrawals.

Rebalancings

We rebalanced this portfolio on July 21, 2021, to its original allocations based on its value of $11,485 on July 20, 2021. This involved selling $760 VIOV, $285 VUG, $105 USMV and $225 REET, and buying $635 TLT and $235 GLDM. We rebalanced again on July 22, 2022 based on the balance of $9,753 on July 21, 2022. This involved selling $182 GLDM, $24 REET, $170 USMV and $156 VIOV, and buying $17 VUG and $210 TLT. We rebalanced again on July 20, 2023 based on the value of $9,776 on July 19, 2023. This involved selling $230 GLDM, $54 USMV, $98 VIOV and $272 VTI, and buying $41 REET and $306 VGLT. We rebalanced again on July 22, 2024, which involved selling $291 VUG, $129 USMV and $252 GLDM, and buying $15 VIOV, $333 VGLT, and $24 REET.

Current Status

We distributed $43 from cash for June 2025 and have distributed $2521 from cash since inception and $259 YTD. Here it is as of June 13, 2025. It is up 1.72% for June and up 3.85% YTD. It is up 34.93% since inception in July 2020. For 2024, it was up 11.06% and we distributed $509.

What Is It

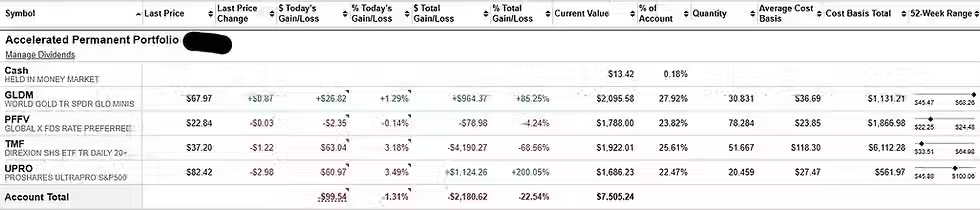

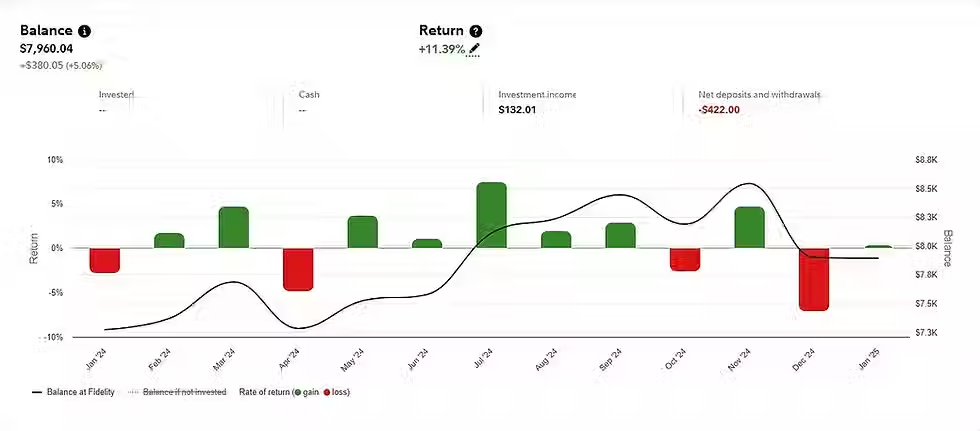

The Accelerated Permanent Portfolio is an aggressive and experimental portfolio that is designed to take advantage of leveraged funds that offer multiples on returns, but is based fundamentally on Harry Browne's original Permanent Portfolio. It is comprised of four different funds in four different asset classes: 25% leveraged stock funds (UPRO), 27.5%% leveraged long-term treasury bond funds (TMF), 25% preferred stock funds (PFF and the PFFV as of January 17, 2025), and 22.5% gold (GLDM). In theory it should yield a double-digit real compounded annual growth rate.

Historical Performance

Here is the current correlation matrix and a backtest with an inflation-adjusted 8% annualized distribution taken monthly.

Portfolio Policies

We will rebalance this portfolio whenever there is a 7.5% deviation from the targeted holding of a fund at mid-month. We will be distributing 8% annualized from this portfolio each month, which is the mathematical equivalent of dividing the ending monthly balance by 150 and distributing that amount on the first trading day of the next month. If the portfolio falls below 80% of its starting value, we will reduce the withdrawal rate to 6% until it returns to its starting value. We will sell the most productive asset as necessary to support the withdrawals.

Rebalancings

Rebalancing was triggered mid-January and mid-July 2021 when UPRO exceeded its target allocation by over 7.5%, in mid-April and mid-November 2022 when TMF went below its target allocation by over 7.5%. Accordingly, on January 18, 2021, we sold $975 UPRO and bought $917 TMF. On July 21, 2021, we sold $865 UPRO and bought $450 TMF, $125 PFF and $300 GLDM. On April 18, 2022, we sold $155 UPRO, $186 PFF and $599 GLDM and bought $941 TMF. On November 16, 2022, we sold $339 GLDM and $286 PFF and bought $500 TMF and $150 UPRO. On October 16, 2023 we sold $238 GLDM, $21 PFF and $332 UPRO, and bought $524 TMF. On June 17, 2024 we sold $627 UPRO and bought $117 GLDM, $303 PFF, and $179 TMF. On January 16, 2025, we sold $305 UPRO, $239 GLDM, and $33 PFF, and bought $553 TMF.

Current Status

We distributed $37 from cash for June 2025 and have distributed $2860 total since inception ($224 TMF, $1117 UPRO, $242 PFF, $285 GLDM and $1034 cash) and $230 YTD. Here it is as of June 13, 2025. It is up about 2.02% for June and up 3.72% YTD. It is up about 4.79% since inception in July 2020. For 2024, it was up 10.79% and we distributed $451.

What Is It

The Aggressive Fifty-Fifty Portfolio is an aggressive and experimental portfolio in the tradition of "Hedgefundie's Excellent Adventure" that is designed to take advantage of leveraged funds that offer multiples on returns. It is comprised of four different funds in that are associated with stocks and bonds in a 50/50 stock/bond ratio: 33% leveraged stock funds (UPRO), 17% preferred stock funds (PFF), 33%% leveraged long term treasury bond funds (TMF), and 17% intermediate treasury bond funds (VGIT). In theory it should yield a double-digit real compounded annual growth rate.

Historical Performance

Here is the current correlation matrix and a backtest with an inflation-adjusted 8% annualized distribution taken monthly. However, its lack of diversification beyond stocks and bonds is expected to make this portfolio more volatile and reduce its overall performance over time. (That is why it's an experiment.)

Portfolio Policies

We will be rebalance this portfolio whenever there is a 7.5% deviation from the targeted holding of a fund at mid-month. We will be distributing 8% annualized from this portfolio each month, which is the mathematical equivalent of dividing the ending monthly balance by 150 and distributing that amount on the first trading day of the next month. If the portfolio falls below 80% of its starting value, we will reduce the withdrawal rate to 6% until it returns to its starting value. We will sell the most productive fund as necessary to support the withdrawals.

Rebalancings and Other Actions to Date

Rebalancing was triggered mid-November 2020 and mid-March 2021 when UPRO exceeded its target allocation by over 7.5%, and in mid-April and mid-November 2022 when TMF went below its target allocation by over 7.5%. Accordingly, on November 16, 2020 we sold $794 UPRO and bought $694 TMF and $63 VGIT, leaving $37 additional cash for the next distribution. On March 16, 2021 we sold $1143 UPRO and bought $1110 TMF, leaving $33 for the next distribution. On April 18, 2022 we sold $126 PFF, $33 VGIT and $615 UPRO and bought $776 TMF. On November 16, 2022 we sold $290 VGIT and $310 PFF and bought $100 UPRO and $500 TMF. On August 16, 2023, we sold $468 UPRO and $15 VGIT, and bought $522 TMF and $44 PFF. On February 16, 2024, we sold $531 UPRO and bought $24 PFF, $379 TMF and $84 VGIT. On November 18, 2024, we sold $593 UPRO bought $493 TMF and $74 VGIT, and replaced PFF with $1100 PFFV. On May 31, 2022, the balance had dropped below 80% of the starting value and so we reduced the monthly distributions to 6% annualized.

Current Status

We distributed $30 from VGIT for June 2025 and have distributed $2860 since inception ($171 TMF, $1305 UPRO, $134 PFF, $235 VGIT and $845 cash) and $192 YTD. Here it is as of June 13, 2025. It is up about 1.28% for June and down 3.72% YTD. It is down 15.20% since inception in July 2020. For 2024, it was up 8.46% and we distributed $397.

What Is It

The Levered Golden Ratio is an aggressive portfolio that is designed for accumulation and long-term needs. Similar to the original Golden Ratio portfolio, it is based on the mathematical golden ratio known to the ancients, which is approximately 1.618 and is represented by the Greek letter phi. It is comprised of seven funds in the following nominal proportions: 35% NTSX; 10% TNA; 10% TMF; 25% GLDM; 15% O; 3% VIXM; and 2% GBTC (formerly 1% BITQ and 1% BITW). The VIXM and GBTC were replaced with 5% KMLM on September 18, 2023. On March 17, 2025, we adjusted the portfolio to these proportions: 35% NTSX; 10% AVDV; 5% UTSL; 5% UDOW; 10% TMF; 20% GLDM; and 10% KMLM. The funds NTSX, TNA, UDOW, UTSL and TMF are leveraged. When the funds are broken out into asset classes, the portfolio is 61% US stocks (equivalent to 31% SPY and 15% IYY (the Dow) and 15% XLU); 15% international small cap value (AVDV); 34.2% long-term treasury bonds (equivalent to VGLT); 8.4% intermediate treasuries (equivalent to VGIT); 8.4% short-term treasuries (equivalent to VGSH); 20% gold (GLDM); and 10% managed futures for this sample portfolio). The leverage in this portfolio is 157.5/100 (roughly the golden ratio).

Historical Performance

Here is the current correlation matrix and a backtest with an inflation-adjusted 7% annualized distribution taken monthly.

Portfolio Policies

We will re-balance this portfolio whenever there is a nominal 5% deviation from the nominal allocations in any fund at mid-month. We will be distributing 7% annualized from this portfolio each month, which is the mathematical equivalent of dividing the ending monthly balance by 170 and distributing that amount on the first trading day of the next month. If the portfolio falls below 80% of its starting value, we will reduce the withdrawal rate to 5% until it returns to its starting value. We will sell a portion of the most productive fund as necessary to support the withdrawals.

Rebalancings to Date

Rebalancing was triggered mid-May 2022 when TNA went below its target allocation by over 5%. Accordingly, on May 16, 2022 we sold $375 GLDM, $92 NTSX, $291 O (including ONL spinoff) and $55 VIXM; tax-loss harvested $36 BITQ and $35 BITW; and bought $332 TMF, $400 TNA and $160 GBTC, leaving $43 cash for the next distribution. Rebalancing was triggered again on September 15, 2023 when TMF went below its target allocation of 5%. Accordingly, on September 18, 2023 we will sell $352 NTSX and $273 GLDM, and will buy $99 O, $346 TMF, $82 TNA and $345 KMLM, leaving $38 for the next distribution. We liquidated the positions in VIXM ($109) and GBTC ($154) in favor of KMLM. Rebalancing was triggered again on March 15, 2025, which led to the following transactions on March 17, 2025 (see also portfolio composition above): sold $830 GLDM, $172 NTSX, $641 TNA, and $1084 O and bought $499 KMLM, $1185 AVDV, $270 TMF, $395 UTSL and $395 UDOW.

Current Status

We distributed $34 from GLDM for June 2025 and have distributed $1757 total since inception ($361 NTSX, $60 TMF, $149 TNA, $92 O, $581 GLDM, $50 VIXM and $431 cash) and $201 YTD. Here it is as of June 13, 2025. It is up about 1.23% for June and up 6.56% YTD. It is up about 1.85% since inception on July 1, 2021. For 2024, it was up 10.79% and we distributed $389.

What Is It

The O.P.T.R.A. portfolio is an aggressive portfolio that is designed to take advantage of the most recent developments in and availability of diversified ETFs over the past 10-15 years. It is comprised of five funds in the following nominal proportions: 16% UPRO; 24% AVGV; 24% GOVZ; 18% GLDM; and 18% DBMF. Each of these funds is relatively new. The fund UPRO is a three times leveraged fund based on the S&P 500. The fund AVGV is an Avantis fund of funds that contains all of their world-wide value-tilted funds and is based on sophisticated factor-based algorithms. The fund GOVZ is a low-cost U.S. treasury strips fund with an average duration of approximately 25 years. The fund GLDM is a low-cost gold fund and the fund DBMF is a fund for managed futures that replicates a SocGen Index. Most of these funds have only been available for less than 10 years in their current forms.

When the funds are broken out into asset classes and accounting for the effective leverage implied by the holdings in UPRO and GOVZ, the portfolio is expected to model 72% stocks (equivalent to 48% S&P 500 and 24% global value); 36% long-term treasury bonds (equivalent to TLT); and 36% in alternatives represented by GLDM (gold) and DBMF (managed futures). This is effectively a ratio of 50% stocks to 25% bonds to 25% alternatives with leverage of 144/100.

Historical Performance

Here is the current correlation matrix of the most similar assets available and a backtest with an inflation-adjusted 6% annualized distribution taken monthly of similar assets and leverage since 2000.

Portfolio Policies

We will re-balance this portfolio on an experimental basis, which will be whenever the U.S. Federal Reserve reverses its most recent course from either raising its Fed Funds rate or lowering it. This is expected to result in very infrequent rebalancing activity but that will be timed with overall macro-economic developments. We will be distributing 6% annualized from this portfolio each month, which is the mathematical equivalent of dividing the ending monthly balance by 200 and distributing that amount on the first trading day of the next month. If the portfolio falls below 80% of its starting value, we will reduce the withdrawal rate to 5% until it returns to its starting value. We will sell a portion of the most productive fund as necessary to support the withdrawals.

Rebalancings to Date

We rebalanced this portfolio on September 19, 2024 after the Fed lowered interest rates the prior day. This involved selling $14 UPRO, $192 GOVZ and $58 GLDM, and buying $40 AVGV and $188 DBMF.

Current Status

We distributed $50 from cash for June 2025 and have distributed $562 total since inception ($53 UPRO, $51 AVGV, $202 GLDM and $256 cash) and $302 YTD. Here is it as of June 13, 2025. It is up about 2.23% for June and up 4.82% YTD. It is up 7.87% since inception on July 1, 2024. For the last six months of 2024, it was up 3.08% and we distributed $260.